After a decade of growth, what’s next? Key metrics and factors driving value creation in 2025

BCG’s 2025 Value-creators Report highlights global shifts, and examines the value creation landscape for South African companies

A new report from Boston Consulting Group (BCG) titled 2025 Value Creators: After a Decade of Growth, What’s Next? provides insights into the global equity capital markets and corporate value creation, including a look at companies in South Africa. The report, which has annually ranked top value creators based on total shareholder return (TSR) since 1999, reflects performance over a five-year period, examines trends through the end of 2024 and considers challenges ahead, such as ongoing shifts in US trade policy.

While the report highlights Asia-Pacific’s increasing dominance in global value creation rankings and North America’s leading position in large-cap companies, companies in the ‘Rest of World’ region – which includes South America, the Middle East, and Africa – have a relatively small presence in the sample and global top performer lists. This collective region accounts for 4% of the total 2,345 companies in the sample, and 4% of the largest companies but a mere 1% of the Global Top 100 Performers for the period 2020-2024, dropping to 0% in Q1 2025.

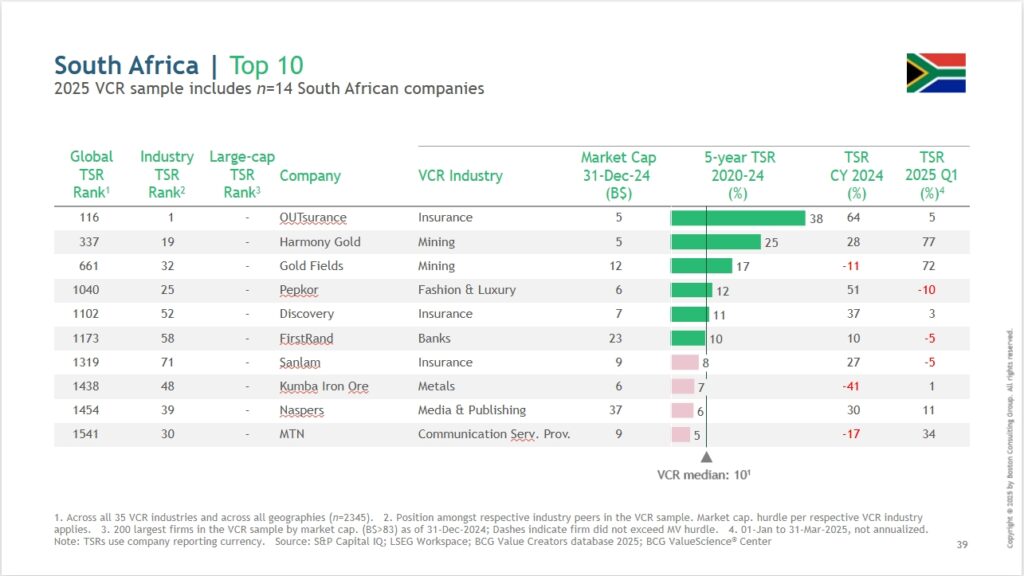

According to the report, the region has underperforming capital markets. With the representation of companies from this region in the Top 100 performers experiencing a decline over the last decade. The 2025 Value Creators includes 14 South African companies. The median 5-year TSR (2020-2024) for these SA companies is 10%, which aligns with the median 5-year TSR across the entire 2,345 global sample.

The report identifies the top 10 South African companies in the sample by their 5-year TSR performance. In first place is OUTsurance which achieved a 5-year TSR of 38% and is featured among the ‘Highflyers’ for the Rest of World region. Other notable South African performers for the period 2020-2024 include Harmony Gold and Gold Fields with a 25% and 17% TSR, respectively – part of the wider traditional industrial sectors such as auto OEMs, oil and gas, metals, machinery, mining, construction, and aerospace and defence — to have seen their TSR performance pick up.

The report notes that value creation in competitive settings is ultimately determined by an individual company’s vitality relative to its rivals. Facing global uncertainties, including potential impacts from tariffs or import barriers, companies are encouraged to focus on winning the fundamentals of value creation (revenue growth, profit growth, valuation multiple, and cash payouts) and boosting resilience through rigorous strategic assumption testing and scenario planning.

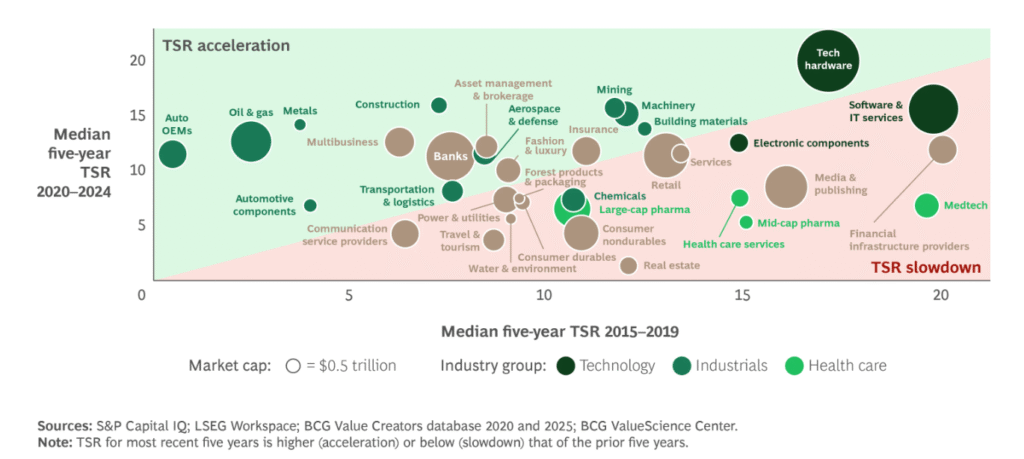

From a global perspective, the report highlights that while technology companies continued to dominate the five-year TSR rankings, many traditional industrial sectors experienced significant acceleration in their TSR performance over the last five years compared to the prior five. With the auto OEMs, oil and gas, metals, machinery, mining, construction, and aerospace and defense sectors all seeing TSR pick up. In contrast, the healthcare sector saw a deceleration in TSR.

Regionally, the report shows a significant shift, with Asia-Pacific companies showing a strong ascent in the global rankings, capturing 68 spots on the list of the top 100 value creators despite accounting for only 40% of the companies in the overall database sample. This strong showing was notably driven by India. Conversely, North American firms took 28 spots in the top 100, down from 38 the previous year, while representing 38% of the database. European companies were less represented among the top 100, securing only three spots despite accounting for nearly one-fifth of the full database.

The report acknowledges the declines observed in stock markets during the first quarter of 2025 due to increased economic uncertainty from shifting geopolitical and trade landscapes. Despite these declines, the expectations premium in current valuations for US non-financial companies remained near a historic high as of the end of Q1 2025, even exceeding the peak seen at the height of the dot-com bubble in 2000.

For companies operating in diverse global markets, including Africa, the report’s insights on navigating uncertainty are particularly relevant.

It underscores that confronted with turbulent times, the companies best able to see and seize shifting opportunities are those most likely to succeed, positing that the most vital companies will win the next game. Corporate vitality, a metric developed by BCG, assesses a firm’s ability to translate strategic advantage into profitable growth by analysing factors related to strategic outlook, technology, people, and culture.

To thrive amidst ongoing uncertainty, companies must return to the fundamentals of value creation: focusing on revenue growth, profit growth, valuation multiple, and cash payouts.

Furthermore, boosting resilience to global macro climate shifts through rigorous identification and pressure testing of strategic assumptions is essential.

Notes: The BCG Value Creators report is based on data from S&P Capital IQ and LSEG Workspace, leveraging BCG’s Value Creators database and ValueScience® Center. The report includes over 2,300 companies from 53 countries. Russian companies were omitted from the analysis, and Argentinian and Turkish firms were eliminated due to hyperinflationary environments skewing valuations.

About Boston Consulting Group

Founded in 1963, and with offices in over 50 countries, BCG’s diverse, global team comprising of 30 000 plus people bring deep industry and functional expertise and a range of perspectives that provide clients with management consulting solutions. Through its transformational approach aimed at benefiting all stakeholders, BCG empowers organisations to grow, build sustainable competitive advantage and drive positive societal impact. For more, go to www.bcg.com.

BCG is well established in Africa, with offices in: Cairo, Casablanca, Johannesburg, Lagos, and Nairobi, bringing together a team of nearly 600 collaborators. For more about BCG in Africa, go to www.bcg.com/Africa.

Share via: